Featured Image Credit : IBM

Final Part

Hello, welcome back, I am elated to present you the final part of this blog series. I hope you liked the Part -3. When I decided to start this, I thought it would be a quick write up for me, as I perceived that I knew well about the crypto universe. But, as I started dwelling deeper, it became very clear, that it was not enough.

For me, more than writing this, it was the learning period, that I really enjoyed. I went into various literatures for months. You might say that even after months, I could just manage to write this much quality. But, again the take away for me was the learning period. As I had to make sure that when I will have a conversation with you, it has to make sense to you in as simple way as possible.

So, far we saw the 5 reasons, why blockchain based crypto currencies will play a major role in shaping our future society. But, as they say, that there are no free lunches, there are multiple challenges as well in front of the booming blockchain ecosystem.

In today’s article we will discuss those challenges, and the silver linings.

Challenges for Blockchain

When we talk about challenges, there are many, not one. The biggest is scalability. If a universal financial system is a product, it should be scalable. At one end, we are talking about transacting in smaller denominations, and at the other end, it takes ~10 minutes for a transaction to be stamped on the protagonist of the blockchain, Bitcoin.

Once the world gets into decentralized finance, it will be an avalanche of transactions. When every piece of land, every new art piece, and every new experience will start transacting in bitcoin, the sheer magnitude of computation will choke the system, by its neck.

In no way, a single chain can solve all the problems of our complex human world. We cannot get into centralization when the whole point to start the fight was decentralisation. But, my friends, who says there can be only a single blockchain kind of world?

The beauty of us humans is, that we solve things, and evolve with our world. We shape it. It cannot be a single chain, it will be a web of chains, reaching out to all of us, in their own digital ways. Each chain can have its rules, security, fraud detection, consensus, currency, and users.

At some time, all these chains add their input to a final ledger. The Ledger of Human History, from some point in future for our generation. Imagine this like a river system, small tributaries, falling into rivers, before reaching the depth of the sea.

We see our history, our ancestors tried their best to pass on the messages ahead. Could be on the stones, or on the palm leaves, still, the majority of our human history is unknown. We use our imagination and calculation, to only connect the dots backwards, the majority is lost forever. There are new discoveries here and there, in the depths of mother nature, but nothing is written, minuting the entire human history. This changes with blockchain, that is what I said, The Ledger of Human history.

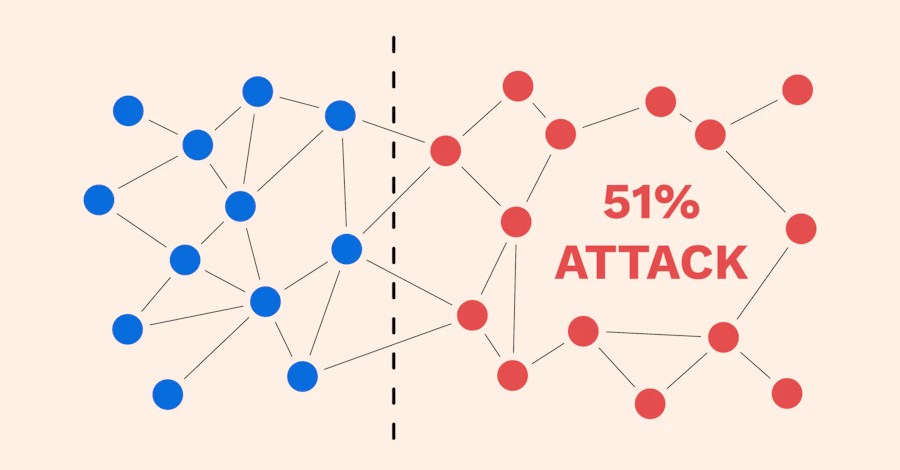

51% Attack

In this, 51% of the network participants are controlled by one entity or group, with malicious intent to change or alter the blockchain. 51% attack is very unlikely for Bitcoin or Ethereum. As per Investopedia, it will take more than $10.13 billion to do a 51% attack on Bitcoin, for Ethereum it would be around $9 billion. And, as the network grows further, it makes the 51% attack further expensive.

Also, as the blockchain ledger is public, the network will immediately identify the attack, and measures can be taken to restore the ‘honest’ chain. This will give a very short time span for the attackers to spend the funds. Hence, attacking versatile blockchains like Bitcoin and Ethereum, is not only costly, it is very hard, gives a very short time for attackers to exploit, and an attacker tends to lose more than they could ever gain.

The Blockchain Trilemma

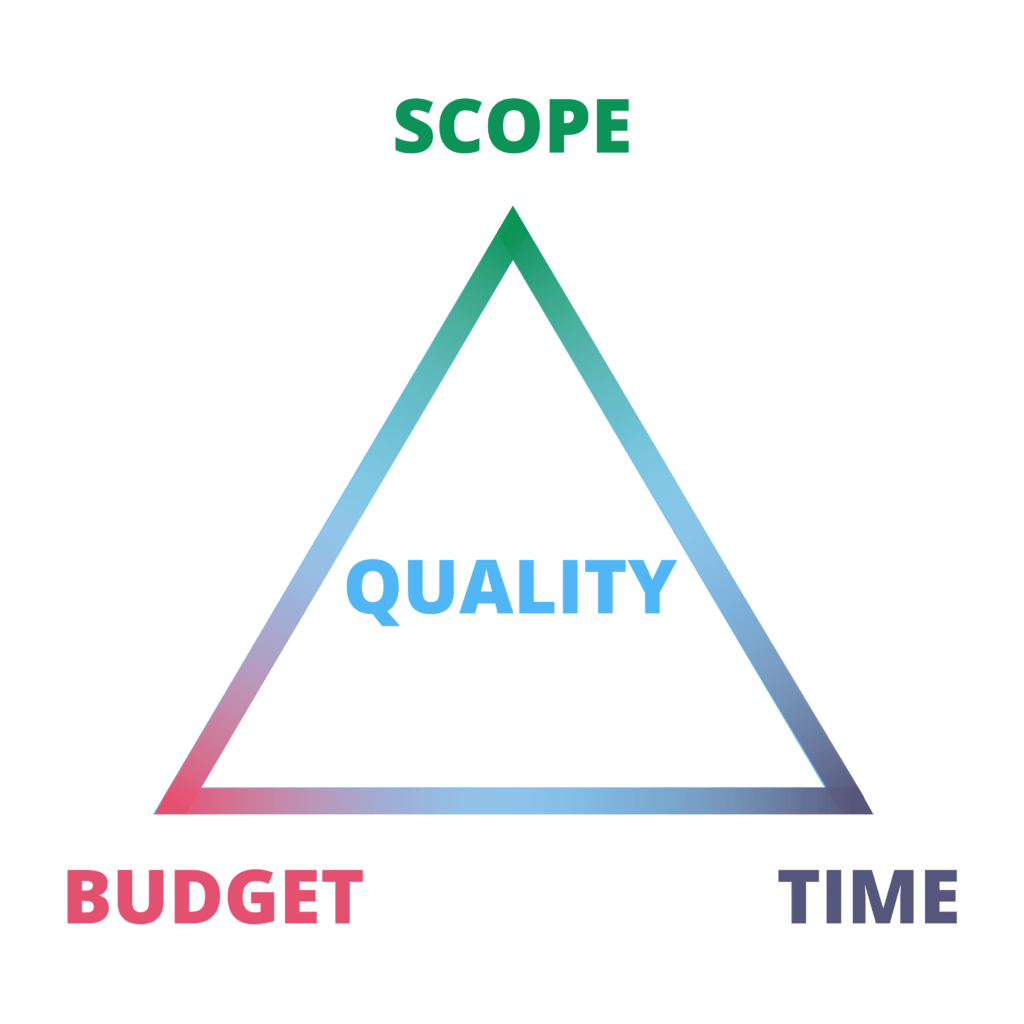

In Agile Project Management, there is a concept of the Iron Triangle. It has Time, Scope, and Budget as three opposing forces, and the combination of them determine the quality or value the customer derives from the project completion.

If the time is too less, it will impact the budget and scope. If the scope is suddenly increased, more time will be required, and more money. If the budget is too less then the time and number of the task will increase. Along similar lines, there is a blockchain trilemma, as well.

Scalability – Security – Decentralisation

As we were discussing before, in order to handle the traffic of a large number of transactions, the transaction processing time should be less. This means that the block creation speed of the chain needs to be accelerated.

But, if the block creation becomes too fast or easy, it will hamper the security of the network. Moreover, to accelerate things, we cannot rely on the low computation power offered by small nodes, instead, we need fast computers. And, since that cannot be afforded by many people, it will make the network more centralized.

If we want our chain to be very secure, then it should be really hard to mess with it. Like in Bitcoin, it takes considerable computational power to mine every Bitcoin block, this makes it harder and costlier for hackers to tamper with the chain. But, this also adds time to the transaction processing rate of the network. I think the future use cases of blockchain networks, will be attempts to find a balance between these three pillars while trying to provide utility/value to normal people like you and me.

As we speak, some of the brightest young minds are already working on solving more than the above-mentioned problems. Bitcoin Lighting Network aims to solve the scalability issue on the core Bitcoin blockchain. This will free the Bitcoin chain from recording each and every transaction, similar layered solutions can further decrease the load on the network, and provide swift decentralised networks. Ethereum blockchain supports smart contracts that can help users to build escrow mechanisms, automatically trade value, and invest.

Decentralised finance is growing rapidly towards us. All across the world, people are losing faith in fiat currencies. As they are no more just tradable things to help people exchange value, they are also used by governments as a tool to exercise political supremacy beyond their geographical borders. Since the supply of money is decided at the central level, it is a matter of time, before some will make the right decisions, and some will make wrong decisions.

Governments will come and go, and bureaucrats move on to different things, but whenever retarded, incorrect, or not well-thought-through financial policies are implemented, the suffering is borne by the common people. One government’s bad deeds are hurdles for the new ones, and hence finance cannot be fulfilling for everyone until it is fragmented and regionally centralized. Everyone plays their game in their playground, while the ecosystem is extensively global.

The Ending Notes…

I started the concept of the ending notes, while I was writing my book. For me, it is an instrument to summarise the elaborative discussion in a compact message. While the key takeaway will be different for each one of you, this section juice out the entire discussion.

Initially, I was sceptical to use a bold title like ‘Why Crypto is the future’ but over the course of researching, learning, and writing this long blog, which took a lot of time. I am happy that I was able to convince myself, that it is indeed the future. It solves a lot of problems that are haunting our global society. Moreover, it empowers the participants, motivates them to be honest, and rewards the community for their support and love.

The fiat currency system will take a side seat in the future financial journey of us, humans, into this vast universe, rolling over a spherical and habitable ball, in darkness. And, this will happen not because there are bad people managing it, but because the fundamental flaws of a centralised system, especially in finance, will force this natural law of selection.

I thank you for giving your time and reading this. Just like every other older generation, the decisions made by the generation living and thriving on this planet right now will shape the world, our children will inherit.

Let’s build a transparent, democratic, and convenient one for them.

Thanks.

~R

One Reply to “”