Featured Image Credit : IBM

Part-2

Thanks a lot for reading the Part -1, if you actually did. If you have not, you can click on the above link. In the earlier, part we discussed about the security aspects of blockchain system for various use cases. In this part we will talk about next two plus points of crypto currencies, in our context.

2. It’s border-less

All the currencies that we know are governed by their respective central banks and government. Now, even if they are honest and doing their best of the work, relative currency price fluctuation is inevitable. And, hence there is a huge disparity in the purchasing power of people who are generating similar value in different parts of the globe.

In contrast to this, crypto markets are global and are controlled by a vast network of peers that can be from any part of the world. If 1 bitcoin is $100,000 in the US, its worth will be the same in India as well, or in Nepal, Cambodia, or wherever. It is not affected by how India or China individually are performing economically, rather it reflects how are we doing things on the global landscape.

Though, India and China hold the might to influence crypto markets, they are not at the end of it, there are not all, same goes for the US, Russia, and other European giants. This is the beauty of decentralization, a global system that can be so stable that national issues cannot bring it down.

Let’s take an example of Remittances.

Many of our friends, cousins, family members, or relatives are working and living abroad. They send back money to their families from different countries. Now, this money has to travel a long distance, and its routes comprise multiple intermediaries, that are helping in completing the value chain, and hence they charge fees.

Let’s talk about our beloved Canada and India. As per Statistics Canada, in 2017 India received a whopping $794 million as remittances from Canada. The only country above India was the Philippines, which received $1.2 billion, God bless them. The fee paid by the remitter ranged from 2% for an amount above $1000, 11% if the amount is less than $200, and 6% otherwise.

If you can notice, the lesser denomination you send, the costlier it will be for you. It means that those, who actually needed the most out of that dollar, lost the most. As there is a specific cost for each intermediatory who will facilitate this transfer of money/value. Everyone has to feed their stomachs, right? But, the person who is slogging his/her ass to earn that money, and send it back to his/her family, will be the one, who will take the hit.

This changes on the blockchain, this changes with Bitcoin, and this changes with other cryptocurrencies. We can send value to anyone irrespective of the distance, and the fee will be dependent on the performance of the overall global network. So it is the same for sending money from Delhi to Mumbai, or to send to Los Angeles. Also, we can easily send small denominations, it is the same for the blockchain. This is how crypto over the blockchain is knitting the whole globe in a single financial net.

3. It is Transparent.

Imagine a scenario, in which 4 men are selling fruits in a shop in a village. Each participant is equally invested in the venture and wants to make sure, that the earning should be divided equally among them. They are new to each other, and hence trust is scarce.

Someone can sell fruits and can misplace that money partially or completely. Hence, they decided on an approach, the moment a sale is happening, each one of them will note that down in their respective notebooks. At the day’s end, they sit together and write this on a final ledger, that will reflect the sale of the day.

Now, unless all of them or 3 of them, agree on the amount of each and every transaction, it will not be captured on the final ledger. Since all the notebooks are open in front of everyone, it will be easy to identify and remove any discrepancies. If any one of them tried to fraud others, it will be instantly visible, and that person will be denied his share and will be abandoned.

It is in the best interest of each participant to play in good faith, as the deeds done with bad faith are instantly visible, and gives punishment or negative reinforcement. Working on the same principle, blockchain adds a very important and missing flavour of transparency in the financial system.

If we are performing an operation and transferring a value packet to a place, we should, if we want to, can see the various intermediary routes that our packet took to reach there. And, we should be certain, that the value packet cannot be tempered.

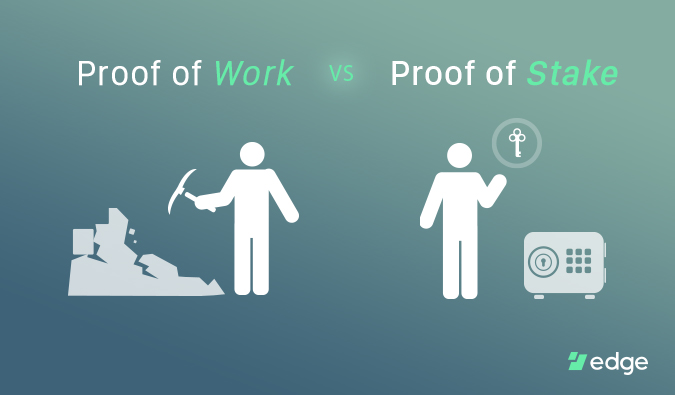

Proof of work is one of the methods to reach consensus on a blockchain, and Bitcoin currently works on the same. The concept is very simple, as a participant in the network, you have to solve a mathematical problem. And, in order to solve it, one has to deploy computational power, and this needs electricity. This is also a reason that the Proof of Work mechanism is criticized, as it adds a significant Carbon footprint. But, as a concept, it is very fruitful.

Maybe it is not suited to run the global financial system, but for systems like E-voting in elections, International Monetary Grants, National Defence-related systems, etc. Where system security and accuracy are paramount, Proof of Work is best suited. While competing to mine the next block and earn rewards, the participant who successfully calculates the right ‘Hash’, immediately broadcast it to the network. Once the right solution is found, it is easy for the other participants/nodes, to validate the solution.

The protocol automatically adjusts its problem level ‘hash rate’, to ensure that the next block is minted around every 10 minutes. If there are too many participants (high hash rate) to solve the problem, the system will make it harder, if there are fewer participants (lower hash rate), the system will make the problem easier. Since it is resource intensive it encourages the participants to work honestly. A dishonest action will be visible to other participants, and they will reject the information as well as the dishonest participant. It will be like you invested so much, just to lose it all.

Proof of stake is another mechanism to reach consensus over the blockchain. In this, a participant has to deposit/lock a certain amount of funds in advance. Post this, one of the eligible participants is chosen by the system randomly, ensuring each participant gets a chance in a fair manner. On successfully validating the next block of the blockchain, the participant receives rewards which are equal to the sum of transaction fees for the transactions bundled in that particular block.

If a participant is found doing wrong, their funds are confiscated, and they are blacklisted from the network. This again will cause immediate financial loss to the wrongdoer, making the system reward the honest participants and punish the dishonest participants automatically. Both Bitcoin and Ethereum blockchains are moving towards Proof of Stake, as it is low resource intensive than Proof of Work.

Thanks a lot for reading till here. When I started this blog, I wrote it in one go, but since the length got too long, I had to break it in multiple parts, like a series. I hope you are liking it, I will release the part-3 tomorrow. till then Stay Tuned.

~R

Part -3 is out! Check out now.

2 Replies to “5 Reasons why, Crypto is the future, for you and me.”