Estimated Reading Time: 4 minutes

Hello,

How are you doing? The second wave of corona sucks. We Indians didn’t even pat our backs properly for our strong immunity, due to already existing filthy living conditions across the nation, and the second wave hits us. This time harder than the last one, though we were mentally better prepared this time, no one was prepared to notice the menace of people dying out of lack of oxygen, hospitals flooded with the cries of relatives, and desperate gasps of struggling patients.

My prayers with the departed souls, may God give strength to the people who lost their loved ones. We have to understand that this is the reality now, even if we get vaccinated, a new variant can anytime emerge, and for a country like India, it is not possible to vaccinate its whole population every year.

Even if this outbreak is an intentional mistake, humanity is paying a hefty price, and if we look at our history keenly, no one gives a fuck about humanity. Every nation is driven by its vindictive agendas. Earlier the world was ruled by religions, then came nationalism, and now the corporations. I don’t know how happy the healthcare sector will be when Corona will go away once for all.

Coming back to the topic, India is a very complex economy, it is culturally rich, the skill set of people differs every hundred Kilometers, and I hope you will agree that the culture in which we grow up and the skills that we acquire, deeply influence our way of thinking that how do we want to make money. This makes the value-generating points in India a very scattered affair. It was only the IT industry that unified the skill set of a large population and made India the powerhouse of the Information Technology Servicing sector.

In the current times, the new revolution that is going in India is in Banking undoubtedly. With the efforts of the government to bring maximum population in the service scope of Banking, the only way for India to capitalize on the mighty young demographics creating value at their respective epicenters.

The New Revolution

The government’s financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’ has opened 41.75 Crore bank accounts till January 27, 2021, the collective amount deposited in these accounts is whooping $18.89 Billion/ INR 1.37 lakh crore. The new infrastructure running on robust IT applications is creating a completely new experience for the people of India. Banking is now in our hands, and in the urban geographies, the customers can indulge in complex banking products with just a touch on their mobile screens.

In January, India recorded around $59.16 Billion worth of capital floating through UPI (Unified Payments Interface) through 2.30 Billion transactions. On the other hand IMPS (Immediate payment Service) totaled an amount equivalent to $39.57 Billion through 346.55 Million transactions. The Banking in India is not as it was a decade back, and looking at the global trends it will be astonishingly different in the next half a decade. Banking will become personalized, enriching, and educating. The time of Safe deposits will go, in the future, the banking customer needs will shift to their money to make money for them.

Mutual funds and P2P (Peer-to-Peer) lending are the things of the immediate future to come. But, despite all these new ways of doing banking, one thing that will stay prevalent at least in INDIA is Cash.

Cash + Digital the only way to go.

Recently, while India is going through an unprecedented surge in the Covid cases, the Cash in Circulation is on its all-time high, since the decade.

Yes, the reason for this is of course that the people are anxious about the uncertain events, future can bring on to them, and not sure if digital banking will be there with them at all the unpleasant places they need to visit if any of their family members fell prey to this new enemy.

Apart from this, the nature of the Indian economy is also a very influential factor that is pushing the role of Cash in Financial inclusion. We have places that are completely hi-tech running on fast Internet networks, and we have places that are not even getting proper 2G networks, it is a complete spectrum that is available in India. Hence, Cash is still one of the strongest tools to include the Indians in the flourishing financial inclusion, especially in the semi-urban and rural areas. They are the places that are the target of this new financial inclusion drive running in India.

How to use this tool effectively?

I always say this, we Indians are still coming out of the effects of Colonisation, still we average Indians tend to save money, for the bad times. Because I don’t know why but we are certain that the bad time will come. Maybe that is how life is, or may be our immediate past generations have heard and felt the same, thanks to the british who looted India like no one ever did.

They left every Indian empty (almost), hence the fear is still in the back of the mind, we admit it or not. Even if we push people against hoarding money and invest it in the banking infrastructure, how can we make sure that they have access to it anytime they want, and hence they can keep that money in banks, which can be used by banks to lend and enable more opportunities in the economy.

Mom-pop Kirana Stores as banks and ATMs

If the government is serious about enabling every corner of our beloved nation, which I hope it is, the small cash economies at every place need to be nurtured, which means generating confidence in the people that their money is not only safe with the Indian banking system it is accessible as well, anytime they want it to.

The two ecosystems that can help this is:

Kirana Banking

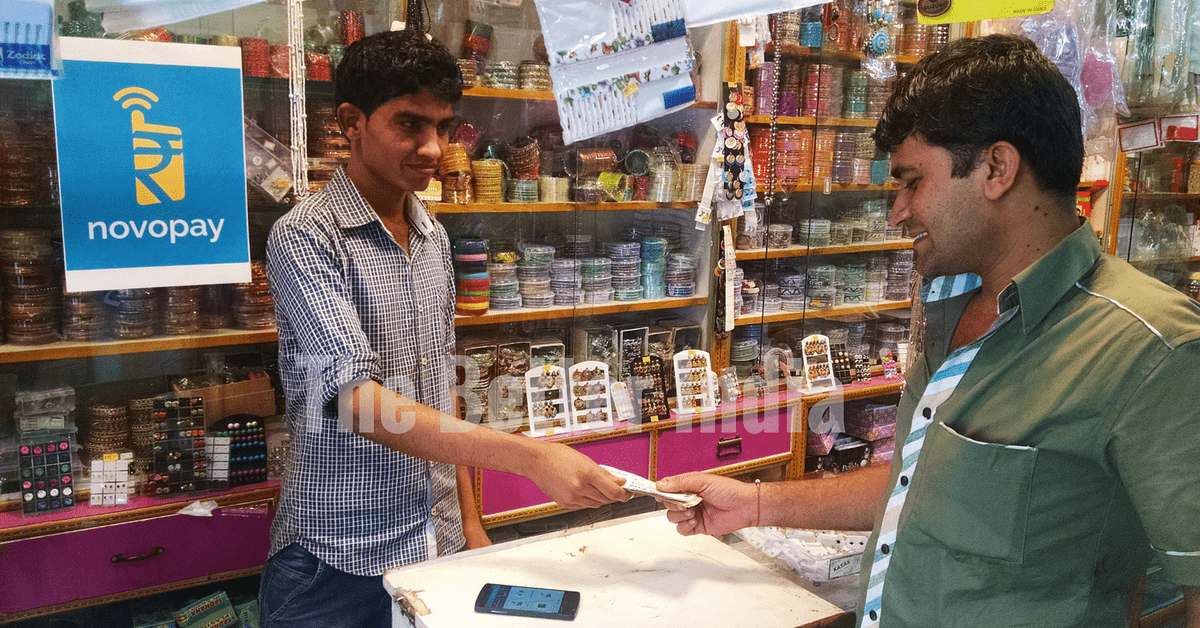

The Indian retail market is very unorganized, and rightly so, in contrast to the western world, where the markets are geographically accumulated, Indian markets are very distributed with shops placed at a remote location. This unevenly distributed, and deeply penetrated network can work as a boon for the Indian financial inclusion saga.

Customers can not only enjoy banking on their mobile phones, but they can also take a step out and do financial transactions at their nearest local Kirana stores. They can pay their Home Loan, business loan, vehicle loans, agriculture, and other EMIs, make cash deposits, withdraw cash, pay for their children’s education fees, and what not.

From there this cash can be transported to the nearest ATMs through a secure and controlled process, and in turn, help so many other people to take advantage of it. This will also enable the businesses to offer much better products to the customers in remotest locations, enabling them to pursue their dreams, build their homes, establish their businesses, generate employment, and contribute in their ways to the Indian success story.

ATMs‘

ATM network can play a huge role in building that trust and reinforcing Indians to put more money in the Financial instruments rather than hidden in dungeons. Because they know they will get it when they want, with the swipe of physical ATM and Debit cards, or through Biometric enabled cash withdrawal journeys.

Currently, India has 2,34, 344 ATMs as of September 2020. As per the World Bank in 2019, for every 1 Lakh adults in India, there are only 20.95 ATMs. And, the reality of the ATM industry is worsening since that time.

The major reason is the operating cost of such ATMs especially in the remote area for the ATM Operators. While they are already haunted by the low interchange fee, their market in the Urban areas is shrinking by everyone’s darling digital transactions. There are major challenges in expanding to network to rural areas. Even if the problem of power can be solved by one Solar setup, the continuous availability of Cash in such areas is a big issue.

The only way that can help India to generate more value from its Cash economy is through the local circulation of Cash. Cash originating, getting transported and dispensed in the same local loop. Unluckily the traditional banks are not present everywhere, even If there is a bank in one place, there is no way that the same bank branch is available at every other place. This makes the procurement process of Cash for ATM operators a decentralized process, hence there are limitations on the extent of control on it.

Every small market needs to be catered and nurtured, there is a demand for Cash, we need to match it with the supply of Cash. Digital transformation will indeed change the face of banking in India, but the backbone to indulge everyone on this revolutionary journey of our nation, the key is localization of cash in my village, cash in my neighbor, and Cash in India.

Thank you.

~R